Finance minister Mr. Arun Jaitely presented the Union Budget for the financial year 2017-18 on the 1st of February, 2017. People had been expecting a lot from this year’s budget since demonetization. Mr. Jaitely’s budget has been gaining mixed responses from the crowd. Here are some of the major points that have been discussed the most by the public.

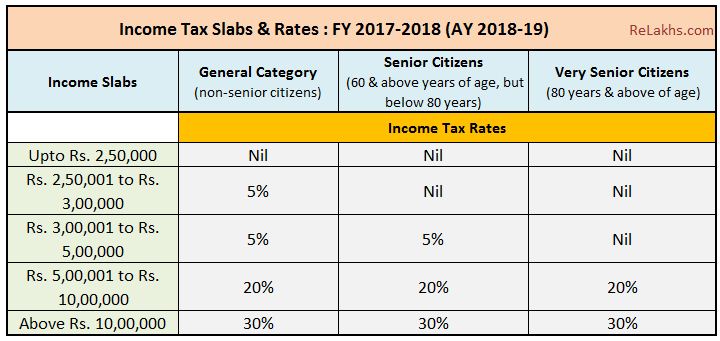

- Surcharge of 10% for those whose annual income is Rs.50 lakh to 1 crore: FM Jaitley

- Reduction in the taxation of those with income between 2.5 lakh to 5 lakhs from 10% to 5%. Jaitley

- Corporate tax rate for small companies having turnover up to 50 crore reduced to 25%.

- Political parties will be entitled to receive donations by cheque or in the digital mode from their donors.

- Maximum cash donation to political parties limited to Rs.2,000.

- No cash transaction above Rs.3 lakhs allowed

- The basic customs duty on LNG reduced from 5% to 2.5% in 2017-18.

- Capital gains tax to be exempted, for persons holding land from which land was pooled for correlation of state capital of Telangana.

- Due to demonetization advance tax on personal Income tax increased by 34.8%.

- 2,74,114 crore allocated for defence expenditure, excluding pension; This includes Rs.86,000 crore for defence capital.

- Second phase of solar power development to be taken up with an aim of generating 20,000 MW.

- Trade Infrastructure Export Scheme to be launched in 2017-18; total allocation for infra at record Rs.3.96 lakh crore.

- Increase in the allocation for scientific ministry to Rs.37,435 crore in 2017-18.

- Total expenditure of budget 2017-18 has been placed at Rs.21.47 lakh crore.

- Defence expenditure excluding pension at Rs.2.74 lakh crore.

- National Housing Bank to refinance Rs.20,000 crore loans in FY18.

- Allocation for women, children at Rs.1.84 Lakh Crore in FY18.

- PM Housing Plan allocation raised to Rs.23,000 Crore in FY18.

- 133-km road per day constructed under Pradhan Mantri Gram Sadak Yojana as against 73-km in 2011-14.

- 27,000 crore to be spend on #PMGSY; 1 crore houses to be completed by 2017-18 for houseless.

- 1.5 lakh health sub-centers to be transformed to Health Wellness Centers.

While all some of these proposed changes have been identified and accepted by the government others may need some time to come into existence. Let us hope that all these new policies turn out to be a blessing for the nation rather than a yearly performance by the governments.

Leave a Reply