Paytm has announced to change your e-wallet into payment bank. With this change Paytm users can now avail almost every banking service with their e-wallets. Many Paytm users, however, are not completely familiar with payment banks. The e-commerce site provides a detailed explainer on what Payment Banks mean and what Paytm users should do.

A Payments Bank is licenced by the Reserve Bank of India. As a Payments Bank, Paytm can now accept customer deposits up to Rs. 1 lakh per customer in a wallet, savings or current account and offer other banking services like Debit Cards, Online Banking, and Mobile Banking. Paytm will continue to offer its wallet services to customers even after converting to a payment bank. It will also enable you to access a range of financial services such as insurance, loans, Mutual Funds offered by their partners.

Here are some of the essential points that you need to know about Paytm Payment Bank:

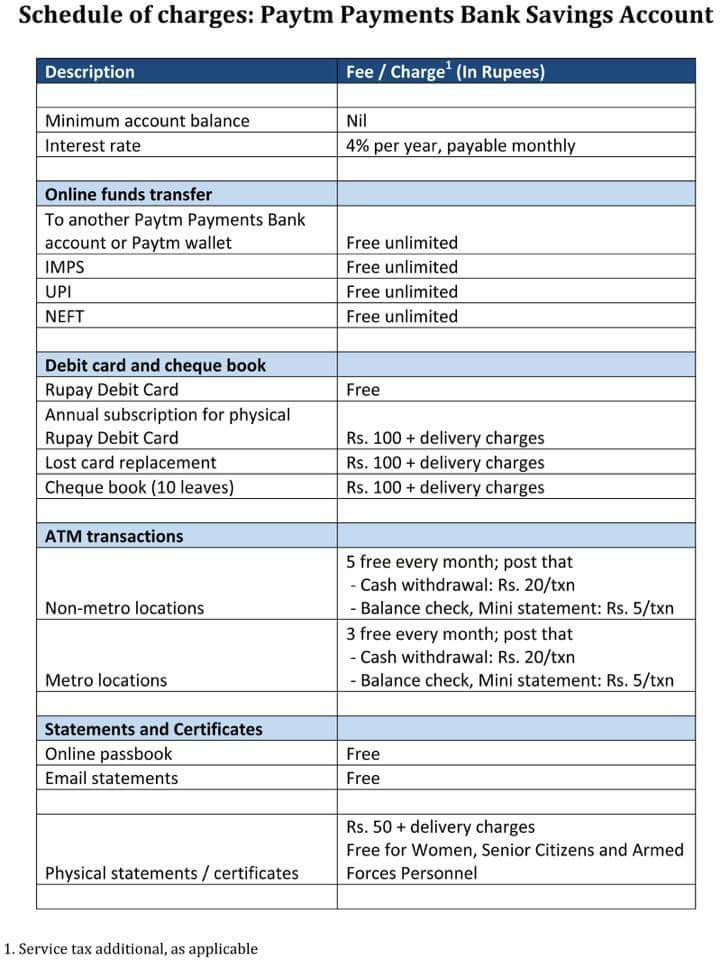

- The bank will offer 4 per cent interest per annum on deposits.

- The first one million customers to open an account with Paytm Payments Bank and reach a deposit of Rs. 25,000 will get a cashback of Rs. 250 instantly.

- Paytm Payments Bank accounts will initially be available on an invite-only basis.

- Paytm Payments Bank will offer zero balance accounts and all online transactions via IMPS, RTGS, and NEFT will be free.

- Paytm Payments Bank can accept Rs. 1 lakh per account, as per RBI (Reserve Bank of India) guidelines for payment banks.

- Paytm will offer virtual Rupay debit cards to customers immediately and physical card on request for withdrawing cash from any ATM in the country.

- Paytm currently has around 220 million customers who use its digital wallet which will be shifted to the payments banks and users will have to comply with ‘know your customer’ (KYC) norms for opening accounts.

- If you are an existing Paytm user your money will automatically be transferred to the Paytm Payments Bank Limited.

- The maiden branch of Paytm Payments bank opens in the National Capital region of Delhi in Noida on Tuesday. The company has a target of acquiring 500 million customers by 2020.

- Paytm Payments Bank will get Rs. 400 crore in investment in the first two years of operation.

Leave a Reply